A report on Aragon Network Votes #1-5

Aragon

Background

AGP-1: The Aragon Governance Proposal Process was approved in November 2018. Since then, there have been five Aragon Network Votes (ANVs) under the Aragon Governance Proposal (AGP) process. In this report, the Aragon Association looks at the accomplishments of the AGP process, challenges encountered, and on-chain statistics about ANV participants. We intend to use this information to better understand Aragon Network Token (ANT) voter dynamics and gain insights into how to improve voter participation, token distribution, and the end-to-end governance process as a whole as project governance transitions from an Association-centric model to an Aragon Network-centric model.

Proposal review

To help authors refine their proposals, every AGP must go through multiple rounds of review. During these reviews, community members have a chance to evaluate the proposal, ask questions, and give feedback to help improve the proposal.

We looked at the history of proposal reviews and found that over half of the proposals that made it onto the final ballot had fewer than ten comments; many of these had no comments at all. Of the proposals that did have comments, they are often one or two people asking clarifying questions of the proposal author. This trend held true even for Finance track AGPs, which proposed to spend money from the Association’s treasury.

Having relatively few comments on a proposal is not necessarily a bad thing. In some cases, this could be due to a well-formed proposal that requires little further discussion or explanation. This is something that may deserve further investigation.

We also find the trend that “contentious” proposals - that is, proposals that had much disagreement in the comments during the review phase - tended to be rejected in the final vote. Examples include AGP-41: Aragon Portfolio Diversification - Acquisition of DOTs and AGP-81: Common Court with Kleros, which both received record-high numbers of comments and ended up being rejected by voters.

Proposal submission

The platform adopted by the Aragon Association for proposal submission was GitHub, a platform originally developed for software development on top of the git protocol but for which the Aragon community found use in the AGP process due to its well-built version control system and collaboration features. GitHub generally worked well for proposal drafting and submission, with the exception of a few proposals in ANV-4 that were affected by either a bug or user error that caused proposal collaboration to break.

Image source: GitHub

After proposals were finalized by their authors, they would be reviewed by the Aragon Association Board of Directors. If the Board of Directors voted to approve a proposal, then the Association Board was responsible for actually submitting the proposals to the appropriate Voting app for a final vote by ANT holders. While this workflow worked well enough (when it worked) it could certainly be improved.

For one thing, the Association as “curator” of proposals is an obvious point of centralization that we intend to remove once governance of the Aragon Network DAO is transitioned to ANT holders in Phase 3 of the Aragon Network launch. At that point, proposal authors will be able to submit their finalized proposals directly to the DAO for a vote using the Aragon client, without the need to rely on GitHub or the Aragon Association as an intermediary in the process. (This doesn’t mean we should or have to stop using GitHub, just that there will be more freedom to use other platforms once the governance process happens outside of the control of the Association.)

Vote participation

A total of 165 unique addresses participated across 48 proposals.

This included ANT holders with as little as 0.054 ANT and as much as 3,555,000 ANT.

On average, proposals received 1,564,860 ANT worth of votes from 25 addresses. The average number of addresses is skewed by outliers on either end of the spectrum, but the average amount of ANT is representative of most proposals, which fell in that range.

The proposal that received the most participation as measured by unique addresses was AGP-42: Keep Aragon focused on Ethereum, not Polkadot. A total of 69 unique addresses cast their votes on this proposal. The proposal that received the least participation as measured by unique addresses was AGP-153: Reduce the judgment powers of AGP Editors. A total of 8 unique addresses cast their votes on this proposal.

The proposal that received the most participation as measured by ANT was AGP-81: Common Court with Kleros. A total of 6,704,532 ANT was used to vote on this proposal. The proposal that received the least participation as measured by ANT was AGP-153: Reduce the judgment powers of AGP Editors. A total of 836,103 ANT was used to vote on this proposal.

In general, process-related Meta track AGPs tended to receive the least attention from voters, while proposals that were either financial in nature or came closer to the “core values” of the project received more attention (and contention).

The most prolific voter was the address 0xd472fa32294977196b9ad47e7865e0d737220e32. This address voted on 42 proposals with a maximum amount of 33,700.98 ANT. There were many addresses tied for “least prolific voter” - having only voted on one proposal each - but the least prolific voter who also held the least amount of ANT was the address 0xe730b30256bd9d3f5cbfdaad0f584307876acd25 which held 1.01 ANT at the time it voted.

Across all proposals, when weighted by unique addresses most votes came in towards the beginning, however when weighted by ANT most votes came in towards the middle or the end.

This suggests that voters with larger ANT holdings (“whales”) were waiting to see how a proposal looked like it would end, and would then either “ratify” the result by voting with the majority, or “swing” the result towards the whale’s desired outcome.

Close voters

One of the patterns we wanted to look at was how ANT holders closest to the project have voted. We term these “close voters” as defined by their proximity to either the ANT crowdsale contract or the Aragon Association multisig contract, looking up to three “hops” away from these contracts to determine proximity.

As we would expect, close voters are not always aligned, especially on contentious proposals. When looking at the vote on AGP-81: Common Court with Kleros we see that crowdsale- and multisig-related voter addresses were split, although the ANT vote was weighted in the opposition’s favor.

When we look at AGP-5: Aragon Flock proposal for Aragon One, a proposal that did not have such contention in the review phase, we see close voters unanimous in their support.

These disagreements over contentious proposals and agreement on relatively un-contentious proposals indicates a healthy level of independent thinking even among voters close to Aragon. So far the project has avoided falling into an echo chamber trap, as even people working together closely on the project voice their contrarian opinions in public fora and at the virtual ballot box.

In general, we note that there are a relatively small number of close voters compared to the total population of addresses that are close to the project. There were 2,403 unique addresses that participated in the ANT crowdsale, whereas we found that no more than a dozen crowdsale-related addresses participated in any Aragon Network Vote. Similarly, while there are several dozen people spread out across the many teams work on Aragon-related projects in some capacity, no more than a dozen or so ever participated in an Aragon Network Vote; a much larger ratio than the crowdsale-related voters, but still less than a majority. (This mirrors the relatively low voter turnout in general, an observation that many are quick to make when looking at Aragon Network Vote data.)

Proposal spending

In total, ANT holders approved spending 9,750,003.22 DAI and 3,605,500 ANT via Finance track proposals in ANV #1-5. These proposals directly resulted in four full time teams getting funded (Aragon One, Autark, Aragon Black, and Frame), about a dozen part-time teams funded (1Hive, ChainSafe, Aragon Mesh, MESG, Empower The DAO, and more), over a dozen Aragon apps built (Agent, Futarchy, Open Enterprise suite, Dandelion suite, Fundraising suite, Committees, Approvals, Tollgate), the deployment of the Aragon Network DAO and the launch of the first Aragon Network service, Aragon Court.

In addition to technical achievements, work funded by the AGP process has directly led to meaningful adoption of Aragon. As of the time of this report, according to Apiary 1,210 Aragon organizations have been created on Ethereum mainnet, securing assets worth approximately 3.92 million DAI directly in their vaults and many more millions of DAI worth of assets via Aragon Agent (e.g. Decentraland and Melon contracts). Most of these Aragon organizations are using templates and/or apps funded as a result of the AGP process.

Spending via the AGP process was not without its challenges. Early on in the process, participants began discussions about how best to implement a budget to keep spending at a sustainable level. In Aragon Network Vote #4, a budget was finally approved with AGP-103: Aragon Network Budget. But the discussion about how to allocate the budget was not without casualty, as one of the full time teams, Aragon Black, chose to withdraw their Finance track proposal due to uncertainty around funding. Challenges like these suggest that robust participatory budgeting practices will become increasingly important as the amount of funds at stake and the number of stakeholders involved in the budgeting process increases.

ANT-ANV correlation

We are also interested in understanding how (or if) the AGP process has had any effect on short-term ANT price fluctuations and trading volume, before or after the vote.

A correlation between ANT price fluctuations and timing of Aragon Network Votes could indicate that the market is pricing in the benefits or risks of Aragon governance. Additionally, a correlation between ANT trading volume and timing of Aragon Network Votes could indicate interest from market participants in affecting governance through the purchase or sale of ANT. Purchasing ANT before a vote would indicate a desire to increase one’s influence over the vote; selling ANT after a vote would indicate a loss of faith or interest in Aragon governance. A lack of correlation in either price action or trade volume could indicate that either the market is disinterested in Aragon governance or that the market believes that Aragon governance has no effect on ANT value.

Note that what follows is a surface-level analysis; more could certainly be done here to more fully analyze the relationship between governance activities and ANT trading activity.

Composite created using charts from Messari.

An initial look at the schedule of ANV #1-5 mapped on top of the ANT price chart for the same time period shows no clear trend between price and votes, even when considering the approval/ rejection of high-stakes proposals in each of these votes. There is some abnormal price action shortly before and after ANV-4; it’s possible though that the price spike a few weeks before ANV-4 was related to the release of Aragon 0.8 rather than related to ANV-4, but this doesn’t explain the price spike just after ANV-4. This is likely a coincidence, since the price dropped nearly as quickly as it went up and then continued declining all the way through ANV-5 into the new year (a general seasonal trend in the crypto-asset market).

When compared with the ETH price chart from the same time period, we can see that the price of ANT seems more closely correlated to price movements in the broader Ethereum ecosystem to which Aragon is closely related, rather than to the AGP process (or anything else going on in the Aragon ecosystem, for that matter).

Image source: Messari

This would seem to indicate that so far ANT as an asset hasn’t “broken out” yet to find a market valuation independent of the Ethereum ecosystem as a whole, and governance is not yet seen as influential enough to move ANT beyond the valuation set by the macro economic environment.

There is evidence that some ANT holders are increasing their ANT holdings shortly before a vote, presumably to increase their influence on the outcome. In the chart below we can see that in the AGP-41 vote, ANT holders increased their holdings as recently as the same day that the vote started. We can also see that some voters became first-time ANT holders on the same day that the vote started.

In some of these cases, this “recent acquisition” is likely the result of a “self-send” from another wallet. In the case of the following voter, we can see an amount of ANT enter the voter’s address near the same time of the vote, and then see the same amount leave back to the same address it was sent from after the vote, indicating a “hot/cold” or “operational/storage” wallet setup. (This is just a guess, of course.)

Image source: Etherscan

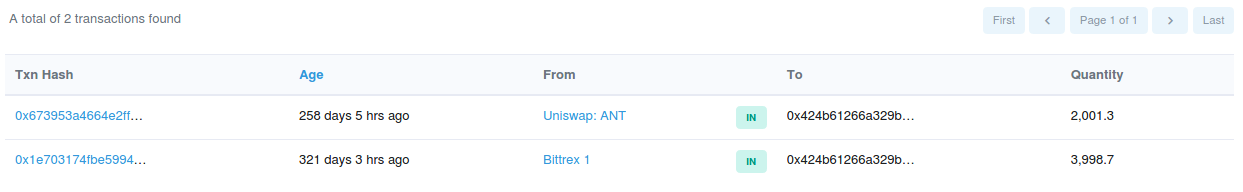

In other cases, we can see that the funds came directly from an exchange into the voter’s address near the same time of the vote, and then stay in the address. In the case of the following voter, they even decided to increase their ANT holdings a couple of months later (possibly to stock up before ANV-3?).

Image source: Etherscan

What we do not yet see evidence of, even for some of the most contentious votes, is “shadow voting”, a term coined by Kyle Joseph Kistner of bZx, whereby someone who has no economic stake in a DAO votes by, for example, executing a loan that borrows ANT right before the voting snapshot is taken and then repays the loan in the block right after the snapshot. There could be several reasons for this, including a lack of liquidity in ANT markets (lending and trading) during the time of the votes, or simply disinterest from participants in “gaming” the system this way.

Conclusions

The Aragon Association is proud to have created and participated in one of the earliest experiments in on-chain governance signalling to go live on Ethereum mainnet. From analyzing the data on the AGP process, including “off-chain” activity in the Aragon forum and AGPs GitHub repo, and “on-chain” voter activity, we come to several conclusions.

The first conclusion is that the governance process has been a great tool for community engagement. There have been moments of contention, as there are in any community, but for the most part the AGP process has been a galvanizing force rallying the community together around a shared vision for progress of the project’s goals. We hope to keep this spirit alive as we transition from an Association-centric to a Network-centric governance model.

The second conclusion is that while we have accomplished a lot with the relatively simple on-chain governance tools available to us right now, we need to continue pushing to develop more sophisticated tools to better capture the broad range of opinions in the community. Examples include the implementation of “Quiet Ending Voting”, which extends the duration of a vote if the outcome is flipped last-minute. Another example is “Delegated Voting”, which gives voters the ability to delegate their vote to another address; an important feature for passive voters to be able to entrust their vote to more active voters, but also useful for certain ANT custody setups. In short, there are techniques from both traditional voting systems and newer on-chain voting systems that we can adopt to improve decision-making and harden our governance system against attack. An in-depth exploration of these techniques and prioritization of their implementation in the Aragon Network is an interesting and important line of inquiry left for future work.

A final conclusion we’ll end on is the observation that while the AGP system embraced debate and politicking as the primary means of consensus-building, we should also experiment with giving direct control of certain decisions to an apolitical decision-making process. We are thinking in particular about futarchy, which relies on market forces rather than politics for decision-making. Futarchy is unlikely to be well-suited to every decision that needs to be made but we have yet to explore in-depth what kind of proposals it is well-suited for. If we can move at least some decision-making into the realm of markets rather than politics this could save ANT holders much time reviewing, debating, and voting on proposals, instead leaving decisions to the most knowledgeable stakeholders who are willing to “bet on beliefs”.

We are excited to take the insights gained through the production of this report and use them to improve Aragon Network governance in the next and final phase of the Aragon Network launch and beyond. As we close one chapter of Aragon governance and open another, we look forward to working with the Aragon community to uphold the Aragon Manifesto and fulfill our shared vision for building a digital jurisdiction open to the world.

Acknowledgements

We would like to thank D5, a data science DAO, for their assistance in surfacing the blockchain data used in this report. A summary of D5’s findings from analyzing on-chain ANV data can be found here. Unless otherwise noted, charts shown throughout this report were taken from D5’s ANV data dashboard. We encourage interested ANV observers and participants to explore the data on their own and share any interesting findings with the community in the Aragon Forum.

And of course, many thanks go to everyone who participated in the AGP process, including proposal authors, reviewers, editors, voters, and the designers, developers, and writers who built the software that made this all possible!

Subscribe to The Eagle for weekly news on the Aragon Network