How to Start a Hedge Fund (from your Bedroom) | Surf Finance

The story of how Surf Finance built a $5m hedge fund on an Aragon DAO.

Aragon

Bureaucracy and a lack of opportunity kill far too many good ideas, so in this series of articles we'll be showing you examples of how normal people without Goldman Sachs on their resume or $100m in finance have built art houses, media companies, hedge funds and consultancies from scratch, using open-source Web3 technology. Using the Aragon OpenStack, anyone with an internet connection and 0.2 $ETH can spin up a borderless organization with a secure treasury, censorship-resistant voting and a fully transparent audit trail in a few minutes. This is known as a Decentralized Autonomous Organization, or 'DAO' for short (read: How to DAO: Answers for Beginners for more information).

In this first article, we'll learn how Surf.finance have built a $5m hedge fund using little more than a Discord channel and an Aragon DAO.

Part 1: Build a Community

In 2020, @Proof - Surf's anonymous founder - was 30, living in the US and working in the gaming industry. He had been researching the cryptocurrency industry for years and had friends making millions of dollars building arbitrage bots, but hadn't yet worked out how to leap full-time into crypto.

With a vague idea of harnessing the wisdom of crowds and latent talent in the crypto community, he began to build a Discord channel by inviting thoughtful members of other projects to discuss the crypto markets and potential investment opportunities. This initial search for talent very quickly became the foundation of a core team and dedicated army of researchers ready to pore through white papers and social channels in search of sound investments.

Accredited investor rules and high capital requirements make raising money one of the most difficult aspects of setting up a traditional hedge fund. In contrast, crypto is an open door to global capital flows and a huge population of willing investors so, even at this very early stage, Surf's Discord channel was already an unofficial hedge fund with approximately ~$1m ready to invest.

Part 2: Incorporate as an Aragon DAO

As the Discord channel grew, the community needed a way of pooling their funds in a trustless way, voting on potential investments and executing trades. They also needed to formalize the organization and provide transparency over the use of funds. Eventually, two trusted developers in the community suggested using an Aragon DAO as the administration layer of the organization to store funds, manage votes and provide transparency to the community.

A DAO can be thought of like a company listed on a stock exchange, but instead of shares, DAOs issue their own tokens. Tokens perform several functions: Most importantly, their price is an indicator of the value of the DAO. If the price of the token rises, potential investors are incentivized to learn about and audit the DAO before they invest. If they decide to buy the token, then they become incentivized to devote their time, energy and resources into increasing the value of their token holdings, effectively becoming unsalaried employees of the DAO. In Surf's case, the core team had already minted a $SURF token and distributed it through a fair launch but, for most projects, this can be done during the DAO setup process.

Here are the steps to set up your DAO:

- Obtain some $ETH. Note: you will need at least 0.2 $ETH to set up an Aragon DAO.

- Send your $ETH to your Web3 wallet.

- Navigate to Aragon and connect your Web3 wallet.

- Click on 'Create an organization'.

- Select the template you wish to use and click 'Use this template'.

- Choose a name for your organization. Click 'Next'.

- Set your thresholds for votes and vote duration. Click 'Next'.

- Choose a token name and symbol. Add some wallet addresses to issue the tokens to. Click 'Next'.

- Review the settings and 'Launch your Organization'.

- Sign the transaction on your Web3 wallet to execute the operation.

Surf launched with a strategy of progressive decentralization, meaning the project would become more decentralized over time. For now, the core team is building out the infrastructure of the project and deciding on its overall direction. Once all the important pieces are in place, ownership of the protocol will be completely transferred to a DAO controlled by all of the token holders in the community. Even though the protocol is not currently controlled by the community, Surf's products are always non-custodial, meaning only the investor has control over their funds.

Part 3: Decide on your Strategy

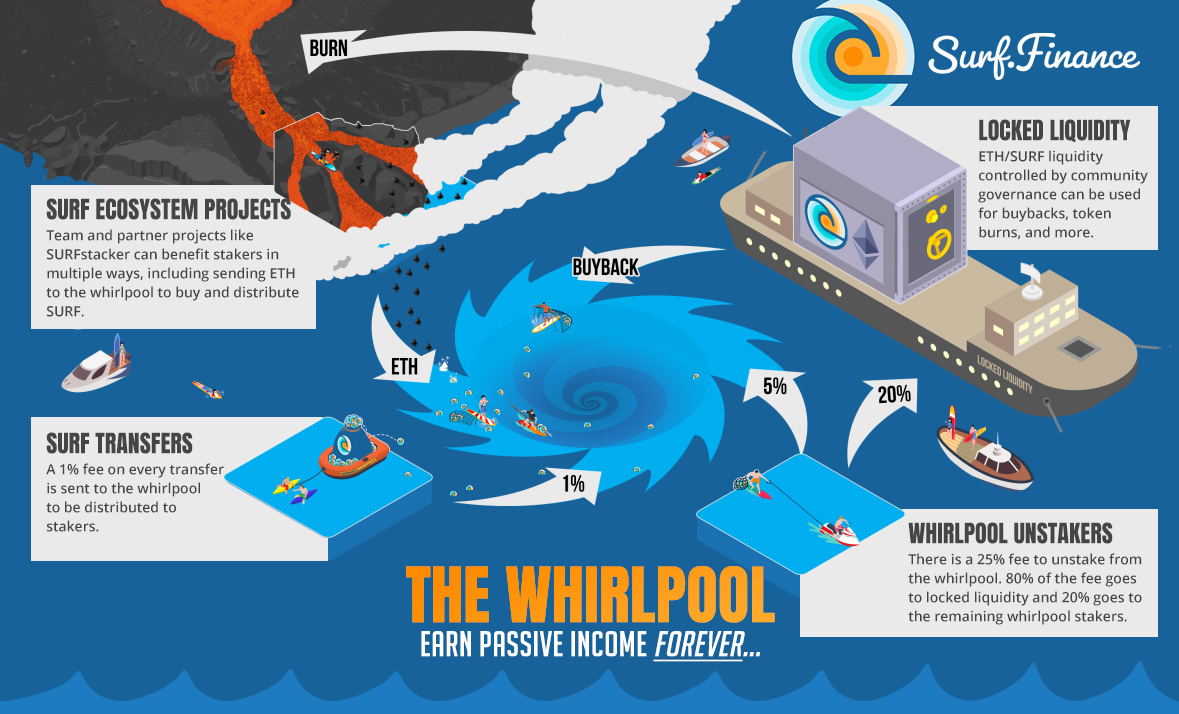

A DAO can use many strategies to grow and reward its members. Instead of a dividend, many DAOs use their profits to buy back the token, pushing up the price. Some will even 'burn' those tokens by sending them to an irretrievable address to permanently increase the scarcity of the tokens and increase everyone's relative holdings. In Surf's case, they built a staking pool called 'Whirlpool' to earn passive income for token holders.

The Whirlpool is a contract on Ethereum which distributes income and profits realized from Surf DAO apps and assets to project participants who have staked $SURF/$ETH Uniswap LP tokens within the Whirlpool contract. The Whirlpool also serves to dissuade predatory market participants by levying a DAO-governed exit fee on LP tokens being withdrawn from the Whirlpool.

Part 4: Manage your Organization

The beauty of a DAO is that it architects out most of the administration of an organization: it serves as a bank vault and payment rail, token holders become the employees, R&D department and marketing team, and DAOs are global and unregulated by default so don't require armies of lawyers or compliance officers.

The Surf team opted for a slightly more hierarchical structure by minting separate $SurfDAO tokens for six community members as the de facto board of directors, able to schedule and approve transactions with a mandate to accrue as much value as possible to the $SURF token. These six members were well-known and trustworthy developers from other projects. Four votes out of the six are required to approve a transaction or three with a 24hr delay.

By this point, the Surf Discord and Telegram groups had 3000 members and the core team had been built entirely of talented community members who love the project and align with its vision of making passive income accessible to everyone. @Proof was able to make the leap to full-time through his returns from his stake in Surf's Whirlpool fund, by then the heart of Surf's investment ecosystem.

In terms of day-to-day management, the community suggests and discusses possible investments throughout the week on their Discord and Telegram groups. Once there is a general consensus about the way forward, the transaction is scheduled and voted on by the $SurfDAO token holders. It is inevitable for there to be members of the community that disagree with an investment decision or partnership, but it is up to the community to judge what weight they give to any dissenting voices, bearing in mind that all token holders' incentives are aligned.

Other than that, the core team hold a voice call once per week to align on overall strategy and discuss any community issues.

Part 5: Grow your Organization

So far, the team have executed 30 votes to invest over $1m in projects such as amplify.art, https://cyberkongz.com and y.at. The fund has grown to hold around $2m in value, and investors have supplied over $3m in liquidity for the $SURF token on the decentralized exchange Uniswap. The investors that have supplied liquidity have earned a yield of over 130% since Surf launched last year. The Surf team continues to build innovative passive income products such as https://polywave.finance on Polygon that supports the core fund on Ethereum and the team now has over 10 developers building out different aspects of the ecosystem.

Part 6: Hedge Funds vs DAO funds

In the language of fund management, there is no greater 'alpha' than decentralization. $100m in committed funds and a multi-year track record of success are the bare minimum to even consider setting up a traditional hedge fund. The number of regulatory hoops and required licenses is formidable. Depending on the investment strategy and where your limited partners and management team are based, you would need to decide in which jurisdiction to incorporate and often end up complying with the regulations of multiple jurisdictions. In short, the cost of setting up a hedge fund with a traditional structure can easily run into six figures. Regulatory authorities can take months to approve applications and even after all this, over 80% of funds will fail. Using a DAO to run your hedge fund does not mean you don't need to comply with financial regulations, but it does offer huge cost savings for both their setup and ongoing management.

In contrast, DAOs are born free on open-source software in cyberspace. Because of this, the DAO approach to security has evolved in a paradigmatically different way. In 'A Technical Analysis of the Genesis Alpha Hack', Adam Levi wrote, "...our approach to security is testing by fire." Such a statement is incomprehensible to a finance industry regulated by the precautionary principle, but for a DAO it makes perfect sense: it is impossible for even a professionally audited codebase to be perfectly secure, so it is far cheaper to embrace that reality, treat hackers as unpaid auditors and amortize the risk through diversification and continuous improvement rather than suffocate the entire industry with regulation. This emphasis on personal responsibility is incredibly effective in an industry where capital can flow effortlessly between competing projects and even rumors of a security breach can defund a project within hours. In addition, many of the opportunities for fraud that regulators are trying to paternalistically guard against in traditional finance are rendered impossible by the transparency of DAO architecture.

Finally, investment research is incredibly labor intensive so by contracting this out to a swarm of motivated token holders, a DAO is already on a much steeper trajectory towards profitability.

Conclusion: What's stopping you?

"Look at it! It's a once in a lifetime opportunity, man! Let me go out there and let me get one wave...Come on, compadre. Come on!" - Bodhi, Point Break

Long term, traditional finance cannot hope to compete with decentralized funds - the asymmetry of opportunity and risk/reward is too great. The efforts of pioneers like Surf, who push through unfamiliar territory to build decentralized armies of domain-specific expertise will compound exponentially over the coming years to become the Blackrocks and Bridgewaters of the Web3 world. It's never too late to start, but today is always better than tomorrow in such a fast moving space.

Head over to Aragon to set up your DAO, reach out to us on Discord or to the Surf team on their Discord for help and advice.

Surf's up!

--

Aragon is building the future of decentralized governance for Web3 communities & organizations. Deploy a DAO, manage your community, resolve disputes and run enterprise-level votes, all within our open-source stack. See the latest at aragon.org, subscribe to our monthly newsletter, join the conversation on Discord, or follow us on Twitter.

Docs | YouTube | Telegram | Github | Reddit | Linkedin | Forum

Subscribe to The Eagle for weekly news on the Aragon Network