Incentivized Governance or Institutional Bribery in Web3?

Curve.fi enabled governance token markets and incentivized governance, aka bribery. Bribe Protocol seeks to extend it to other DeFi protocols.

Aragon

What is Incentivized Governance?

‘Incentivized governance’ is a polite way of saying ‘bribery’, much like ‘private military contractor’ is a polite way of saying ‘mercenary’. Despite their negative connotations, there are still several legitimate use-cases in Web3.0 for these ideas that many perceive to be societal ills.

Different DAOs require different modes of decentralized governance, particularly those involved in DeFi, where protocols such as stablecoin exchange Curve Finance have found market-driven governance ideal. Bribe Protocol seeks to extend incentivized governance to other protocols in the DeFi space.

What is Bribe Protocol?

Bribe is a DAO governance tooling protocol that enables any token holder to more easily get paid for their vote. Users stake their governance protocol tokens, which others may borrow to use in governance votes.

How it Works

- Users deposit and stake governance tokens in the Bribe pool.

- Bidders pay to borrow the whole pool to vote on governance proposals.

- The highest bid is distributed throughout the pool as rewards.

Rewards are paid in the protocol’s native token – $BRIBE – which is also used for governance. One $BRIBE represents a single voting stake in the holder’s chosen Bribe pool.

Origins

According to Bribe’s pseudonymous founder 0xCondorcet, the Bribe Protocol team was created in mid-2021 with highly ambitious goals in mind. They sought not only to address some of the governance questions and problems that nascent DeFi protocols were (and still are) facing, but to build simple tools for running better future democracies.

Their roadmap seeks to transcend the traditional paradigm and current status of democratic governance to address some of the fundamental challenges faced by governments, DeFi, and DAOs alike, including some of those experienced by classical democracies, including:

- Incentivizing participation in governance.

- Ensuring people feel represented in government.

- Staving off populism and majoritarianism.

- Building a social polity that works for everyone.

Governance Marketplaces & Voter Extractable Value (VEV)

Condorcet claims that, based on our unique experience of DeFi governance, DAOs mandate a completely new paradigm of thinking around monetization, governance, and incentivization structures, leading us toward the concept of governance marketplaces. This is an idea, he says, which has only really entered mainstream crypto media and community conversations recently, but is something that has already begun in DeFi. Condorcet thus views the expansion of governance marketplaces as inevitable, given the form DeFi governance structures have taken so far.

The governance voting market is a set of utilities that facilitate the monetization or determination of the voter extractable value (VEV) of tokenized governance votes. If DAO governance tokens are going to be tradable, he argues, it is vital that token holders understand the value of their vote at any given time, compared to other ways a token can be used. We must understand how this impacts the broader DAO ecosystem, as it has important implications for governance.

To realize the value of an individual vote and to build a transparent voting marketplace, Condorcet asserts, votes must:

- Be transactable and liquid, with basic DeFi features – staking, custody, lending, borrowing.

- Have a strong utility associated with them.

- Have monetizable governance outcomes by:

(i) individually effecting governance; or

(ii) being combined with a sizable critical mass of other votes to ensure the coalition commands significant voting power.

The majority of DeFi protocols fail to achieve this third condition. Bribe seeks to extend the final condition and the bribery framework, pioneered on Curve, to the rest of the DeFi and DAO space, he concludes. Condorcet believes that this and making the dApp user experience more intuitive are integral to the attraction and onboarding of more users into Web3 and to growing participation in decentralized digital governance. He claims that Bribe's offering of stable, compounding, and high-yield APYs without the usual risks of DeFi will help achieve these goals, in addition to reducing price slippage for protocol tokens.

DeFi and Price Slippage

To grow big quickly as a DeFi protocol, liquidity and price sustainability are vital, and, thus, so is the issue of slippage. To combat this, Bribe creates governance markets and builds vote coalitions with the explicit goal of minimizing slippage. Bribe is currently the only protocol focusing on this issue, but Condorcet expects many more to emerge throughout 2022.

Under the current system, there is no realistic way for third parties to create and pass governance proposals. Buying enough tokenized votes to meet quorum is prohibitively expensive, difficult, and risky, compounded by the problem of slippage and fees. It would involve buying tokens on every exchange to acquire a significant percentage of the token supply despite the inevitable exponential price surge it would cause.

Incentivized Governance or Institutional Bribery?

The idea of allowing and facilitating – let alone incentivizing – trading in DAO governance votes is undoubtedly controversial.

We wanted democratized finance, instead we got 3 layers of bribe protocols ultimately controlling plutocratic protocol governance systems.

— Ryan Watkins (@RyanWatkins_) January 11, 2022

Color me skeptical this is the end state of DeFi.

Arguably though, Bribe is merely formalizing an existing practice in DeFi governance in a transparent way, accelerating a trend that was already popular. This was most evident recently in a multi-billion dollar governance conflict that has become known as ‘The Curve War’. The Curve DAO governance token ($CRV) and ecosystem was ultimately best able to address the requirements for the realization of the VEV of $CRV, and has emerged as something of a DeFi kingmaker as a result.

The Curve-Convex War

The Curve ecosystem is a rather complex tech stack of decentralized protocols built on Ethereum that ultimately enables users to understand and realize the value of their Curve DAO tokens ($CRV). Owing to its gauge design, every $CRV vote makes a difference, rather than being a majoritarian binary ‘yes/no’ result, as in many other DeFi protocols.

The short of it is that Curve provides inflationary rewards to different pools within the exchange for people to deposit their tokens. Projects want more people to deposit their native tokens into their respective Curve pools in order to make them more liquid. They incentivize this by paying bribes to borrow people’s Curve tokens in order to vote for the reward level of each liquidity pool, controlled by the Curve gauges.

- Curve Finance is a stablecoin exchange and automated market maker designed for highly efficient trading with minimal fees and slippage via user-staked liquidity pools.

- Convex Finance enables $CRV stakers and liquidity providers to optimize their yields by providing liquidity, and proxy vote on Curve gauges with $vlCVX (vote-locked $CVX).

- Votium Protocol is an auction platform where $vlCVX stakers can delegate their voting power and receive rewards from buyers interested in amassing voting power.

DAO governance protocols of Curve ecosystem governance marketplaces:

- Curve uses Aragon for governance and control of the protocol admin functionality, interacting through a modified implementation of the Aragon voting app.

- Convex votes using Snapshot.

- Votium does not currently offer decentralized governance or a governance token.

Users are incentivized to stake stablecoins on Curve, earning trading fees and interest on the liquidity they have provided in exchange. When users stake their $CRV tokens on the platform, in addition to generating a yield, they are allocated a certain amount of $veCRV (vote-escrowed $CRV), which allows them to vote on Curve’s liquidity pool gauges. These gauges control the amount of rewards distributed to users staking stablecoins in each liquidity pool. As such, control over Curve’s governance allows one de facto control over which stablecoin has the most liquidity, via the provision of the highest incentives to stake.

Curve gauge voting is incentivized by other DeFi protocols, such as Yearn and Convex Finance, wishing to inject liquidity, add stability, reduce slippage and earn revenue. The Curve War refers to the competition between these different protocols for control over the governance of the Curve liquidity gauges. Currently, Convex has secured the most $veCRV – ~42% of the total in circulation – and thus has the most voting power.

Convex War

Convex has leveraged this to build a layer-2 protocol that enables users to permanently stake $CRV tokens on Curve as $veCRV, and receive $cvxCRV (tokenized $veCRV) in return. $cvxCRV can itself be staked on Convex to receive Curve rewards higher than if staking $CRV on Curve, as well as the platform’s native token $CVX.

$CVX is Convex’s governance token that users can vote-lock (stake) in exchange for $CRV/$cvxCRV and the ability to vote on the allocation of Convex’s stake in $veCRV to different liquidity pool gauges. Therefore, as Convex controls the majority stake in $veCRV, the governance of Convex ultimately determines Curve’s gauge weighting, and thus the stablecoin staking rewards and, indirectly, each stablecoin’s liquidity. The Convex War is the ongoing competition between various DeFi protocols like UST to vote-lock $CVX tokens in what could be described as a proxy Curve War.

Finally, Votium allows protocols, such as UST, FRAX, and MIM, to incentivize users to stake $vlCVX on the platform in order to control governance on Convex, and thus the gauges on Curve. This multi-layered Curve ecosystem enables the voter extractable value of a single $veCRV vote to be realized and displayed on a user dashboard, Condorcet summarizes.

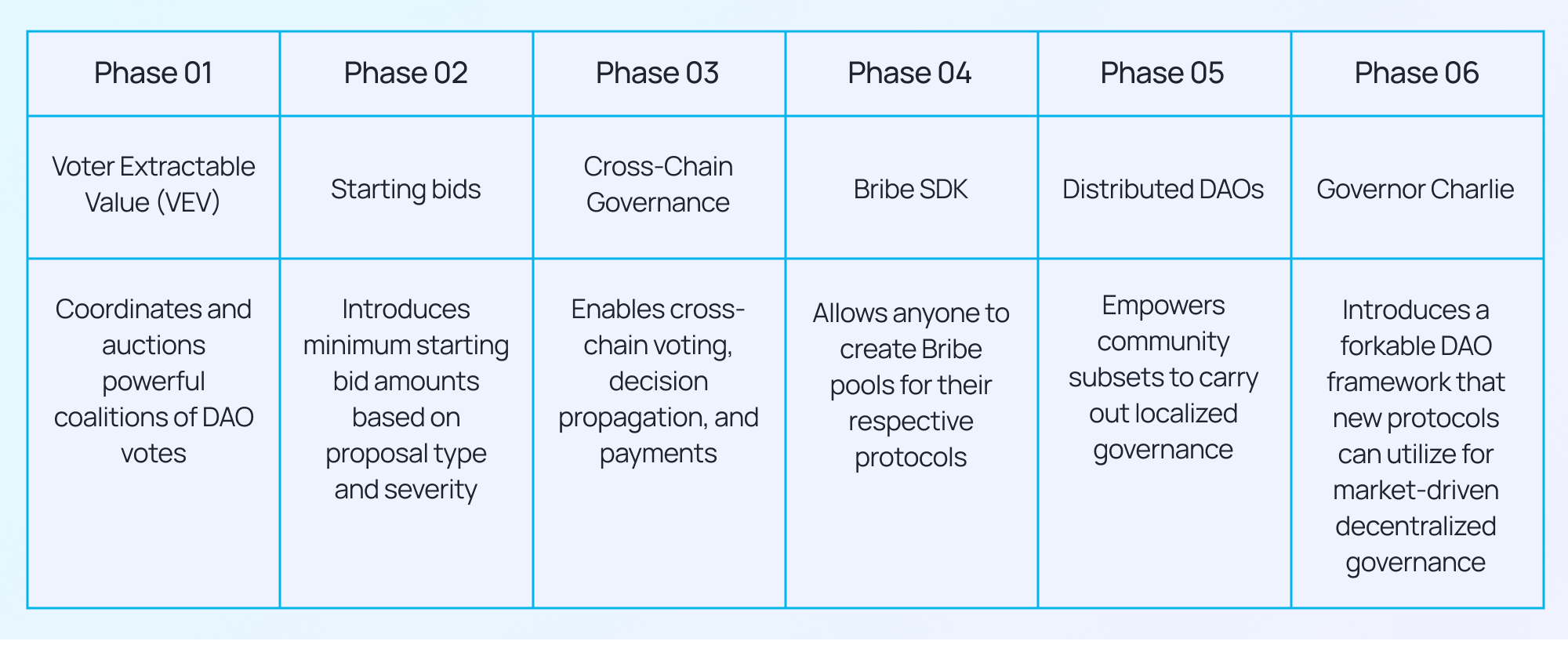

Bribe Roadmap

There are six phases in Bribe’s roadmap for developing DAO governance tooling, which they claim will advance their goals of expanding governance participation and helping DAOs to function more effectively. Condorcet foresees a considerable role for Bribe in the future as a governance tooling and aggregating service that connects all of the different decision-making outcomes of governance in a single bribery mechanism. He believes Bribe can leverage this to systematically model and understand governance outcomes in the long term, enabling any protocol to more easily manage its governance.

Stay tuned for part two of this article, ‘Bribe: the End or Future of dGov?’, where we discuss whether incentivized governance is good for Web3, or simply inevitable, as well as the implications of vote trading for non-DeFi DAOs, the Aragon Network ecosystem, Web3 governance, and democracy as a whole.

Read more:

The Bribe Protocol: Bringing Transparent, Incentivized Governance Practices to the Curve Wars and Beyond, by 0xbrainjar in the Bribe Protocol blog. Published 07 January 2022.

--

Aragon is building the future of decentralized governance for Web3 communities & organizations. Deploy a DAO on Aragon Client or Aragon Govern, manage your community on Aragon Voice, resolve disputes in Aragon Court and run enterprise-level votes on Vocdoni, all within our open-source stack. See the latest at aragon.org, subscribe to our monthly newsletter, join the conversation on Discord, or follow us on Twitter.

Docs | YouTube | Telegram | Github | Reddit | Linkedin | Forum

Sources:

Adamidis, Vasileios. “Manifestations of Populism in late 5th Century Athens,” in New Studies in Law and History, Frenkel, D.A. & Varga, N., eds. Athens Institute for Education and Research. September 2019.

“BRIBE PROTOCOL.” Bribe Protocol. bribe.xyz. Retrieved 08 March 2022.

“How Bribe Protocol Upends DeFi Governance! - 0xCondorcet, Bribe Protocol, Ep. 182.” The Crypto Investor Podcast. Blockcrunch / Jason Choi. listennotes.com/podcasts/blockcrunch-the/how-bribe-protocol-upends-7gIbNoZ_zVP/. 26 January 2022. Retrieved 22 February 2022.

“The Curve DAO: Governance and Voting.” Curve Finance. curve.readthedocs.io/dao-voting.html. Retrieved 22 February 2022.

“Understanding CRV.” Curve Finance. resources.curve.fi/base-features/understanding-crv. Retrieved 22 February 2022.

“Understanding CVX.” Convex Finance. docs.convexfinance.com/convexfinance/general-information/understanding-cvx. Retrieved 22 February 2022.

“Understanding cvxCRV.” Convex Finance. docs.convexfinance.com/convexfinance/general-information/understanding-cvxcrv. Retrieved 22 February 2022.

Ye, Jason. “The Great Curve War (aka. Convex War).” DeSpread. 14 January 2022. medium.com/despread-creative/the-great-curve-war-aka-convex-war-bf702d159fb3. Retrieved 22 February 2022.

“Voting and Gauge Weights.” Convex Finance. docs.convexfinance.com/convexfinance/general-information/voting-and-gauge-weights. Retrieved 22 February 2022.

Subscribe to The Eagle for weekly news on the Aragon Network