The Growth Engine: How veLockers & Gauges Drive Value Accrual

Aragon

For many onchain organizations, governance and value creation have historically existed in parallel, but not in sync. Token holders vote, yes, but does that governance translate into sustainable growth, aligned incentives, or capital efficiency?

Not always.

Aragon’s veLocker + Gauge primitives, part of the Value Accrual Toolkit, are designed to close that gap. They don’t just make onchain organizations more democratic, they make them more productive. By combining commitment-based voting with incentive-directed capital allocation, Aragon transforms governance and onchain management from a decision-making layer into a value-generating flywheel unlocking true onchain ownership.

veLockers: Commitment → Influence → Real Investment → Ecosystem Growth

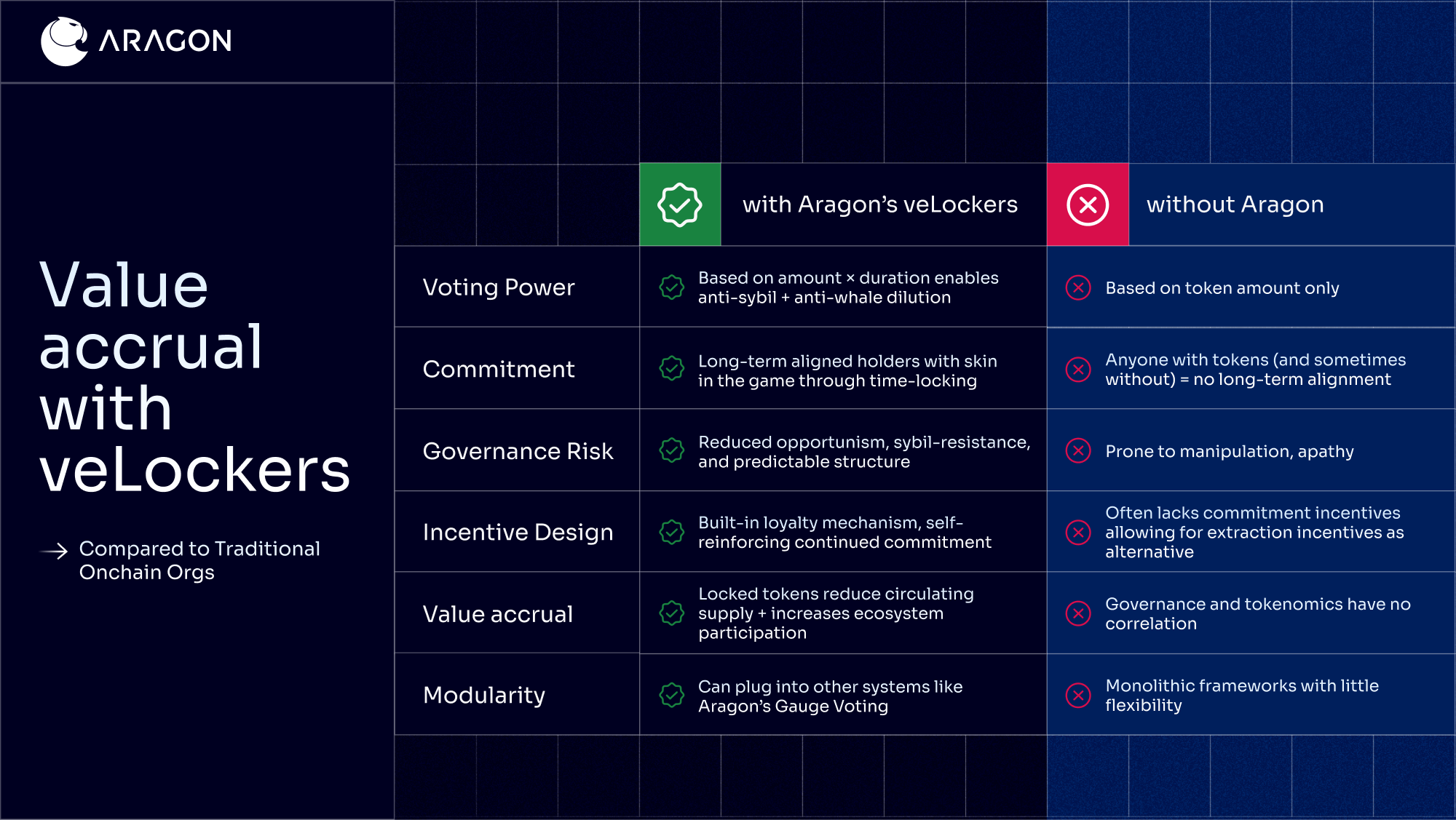

A core product of the Value Accrual Toolkit is veLockers, a mechanism design that allows participants to lock tokens in exchange for time-weighted voting power, issued as veTokens.

This creates three foundational outcomes:

- Incentive alignment: Voting power scales with time commitment, rewarding long-term conviction over short-term speculation

- Value accrual: Locked tokens reduce circulating supply & increases ecosystem participation

- Stronger governance infrastructure: Reduced opportunism, sybil-resistance, and predictable structure

Instead of passive governance by transient holders or those with no skin in the game, veLockers encourage a more deliberate and aligned participant base, one that benefits directly from good governance outcomes.

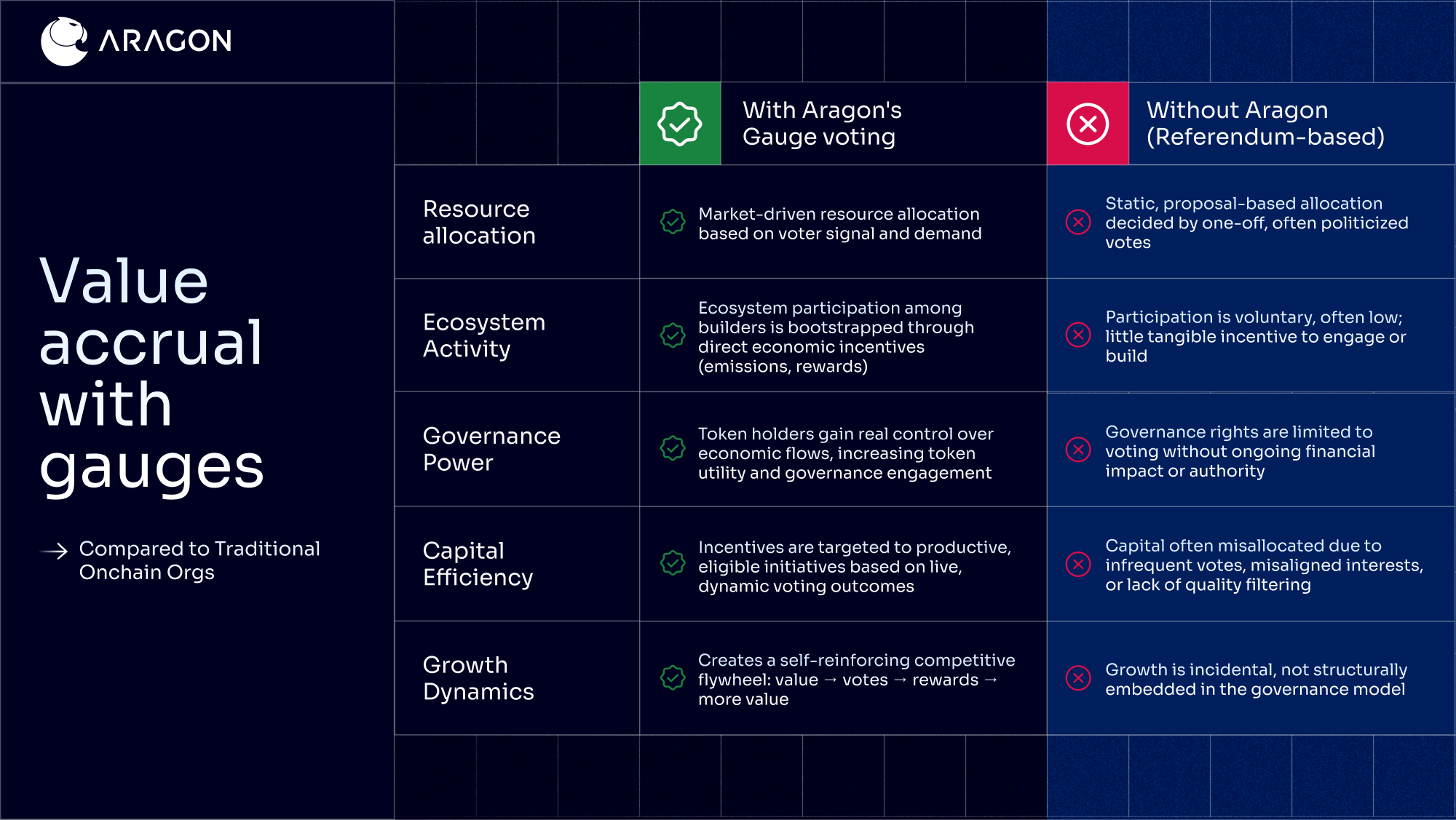

Gauges: Vote-Directed Incentives = Capital Efficiency

Once veTokens are in hand, holders can use them to vote on Gauges, programmable mechanisms that determine where protocol emissions and resources go.

This turns voting into an economic lever.

- Participants are incentivized to engage in governance, not just symbolically, but financially through vested financial interest and potential reward mechanisms.

- Projects and contributors are motivated to align with governance goals in order to earn emissions via gauge votes.

- The community becomes the allocator, replacing bureaucracy with market-driven signal.

The result is a feedback loop, where the most impactful, aligned initiatives receive the most funding, and thus contribute even more value to the protocol.

The Value Accrual Flywheel

When these two systems are combined, locking and voting, a powerful incentive loop emerges:

- Token Locking

- → veToken Issuance

- → Gauge Voting

- → Emissions to High-Impact Projects

- → Ecosystem Growth & Protocol Usage

- → Value Accrual

- → Incentive to Lock Increases

This directly enables the fundamentals of onchain organization and tokenomics to become not a time-consuming, impractical cost center, but instead, an efficient growth engine designed to last. Not through speculation, but through programmable, incentive-aligned, and value-accruing coordination.

The Bottom Line

veLockers give participants skin in the game. Gauges let them decide where that skin goes to work. The outcome? Real investment for long-term value generation.

Together, they make tokenomics not just a structure, but a strategy, a way for onchain organizations to align incentives, compound value, and scale with integrity.

With Aragon, building your organization onchain isn’t a checkbox. It’s a catalyst.

Subscribe to The Eagle for weekly news on the Aragon Network