The Ownership Token Framework: A Verifiable Standard for Tokens as an Investable Asset Class

If we want tokens to be investable and valuable assets, there is one ingredient we can’t keep dodging: ownership.

Aragon

If we want tokens to be investable and valuable assets, there is one ingredient we can’t keep dodging: ownership.

ERC-20 tokens (whether we call them utility, network, or governance) are first and foremost financial assets. “Ownership Tokens” is the correct lens for evaluating tokens: as financial assets with enforceable economic rights.

This cycle’s reality check is that many tokens lack enforceable rights and credible value flows, and they’re being priced accordingly. This is not just a cyclical pricing issue. If founders can’t clearly answer “why is this token valuable?”, tokens won’t be treated as investable assets, raising gets harder, and the best teams default back to equity and private markets.

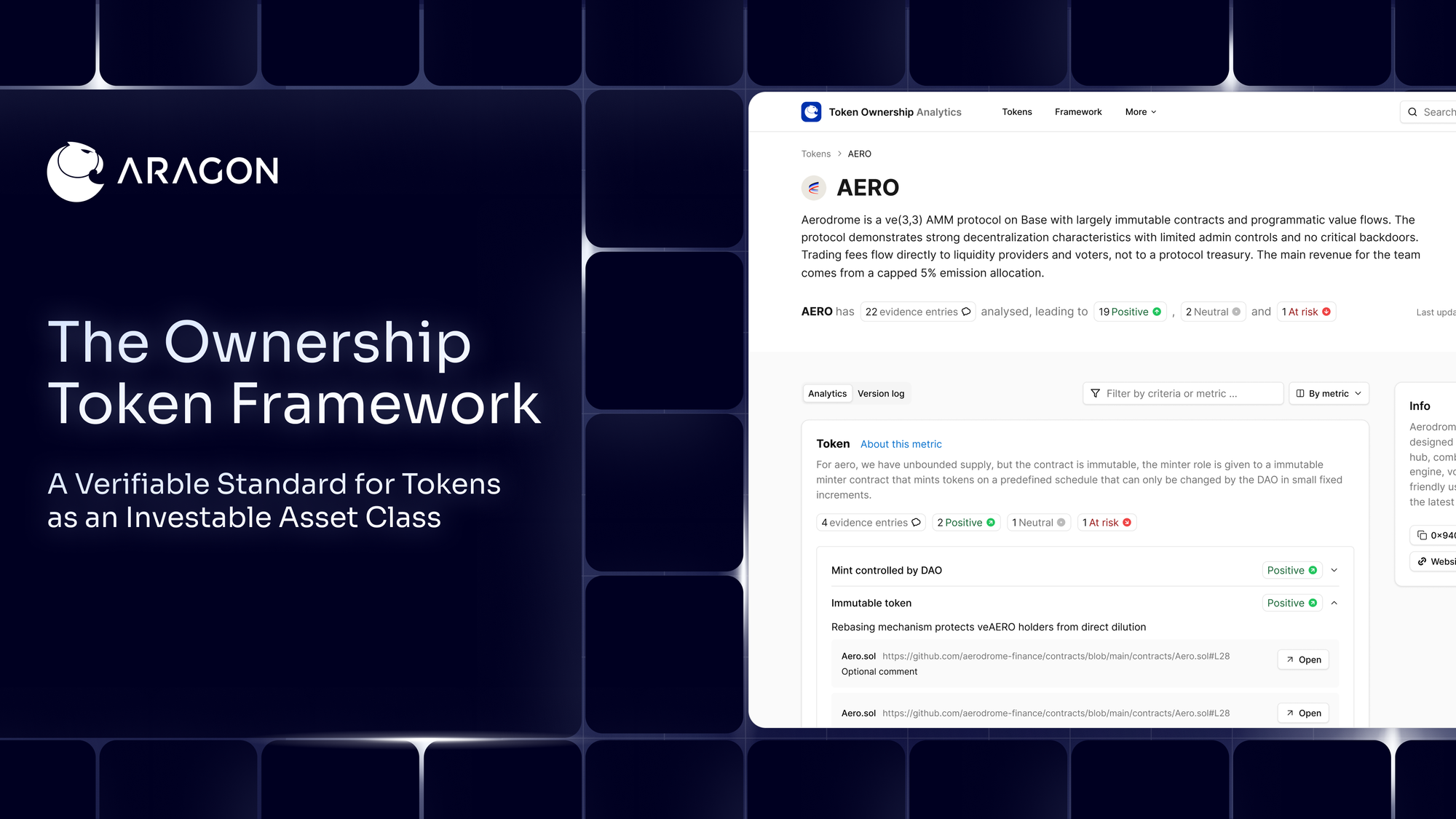

Today we’re announcing the Ownership Token Framework, a framework that makes token ownership rights explicit, verifiable, and comparable. It’s a response to what the market is signaling: tokens won’t be treated as investable assets until tokenholder ownership is clear and enforceable.

Value has been blocked from accruing to tokens

For years, value has been structurally prevented from accruing to tokens, not because the technology isn’t there, but because the default pushed teams in the opposite direction:

- Regulatory pressure led to avoid explicit tokenholder rights and value flows. “Governance utility” became a substitute for ownership, and complexity became a defensive posture.

- No explicit claim became the norm. Many tokens have no enforceable claim on assets and cashflows.

- Misaligned structures put token and equity value at odds. Valuable assets were held by Labs entities incentivized to maximize equity over token value.

- Obfuscation by default made diligence harder. Investors can’t quickly tell what rights exist, where value is generated, how it reaches the token, or what remedies exist if commitments are breached.

The result was a default architecture where the token signaled ownership, but lacked enforceable rights.

When ownership is unclear, extraction thrives

When rights and value flows aren’t legible, economic control becomes discretionary. Value can be captured elsewhere: by insiders, intermediaries, and offchain entities that control key distribution channels.

That is the environment grifters exploit. They don’t need to “break rules.” They operate in the grey zone created by unclear rights and opaque structures. Memecoins compound the problem by normalizing lack of fundamentals, making it even harder for serious projects to signal credibility.

The problem also shows up in well-intentioned projects. Value can leak offchain through entities, interfaces, and operational rails. As a result, “entity-owned vs tokenholder-owned” questions become economically material and escalate very quickly.

The result is predictable: markets discount tokens that can’t credibly prove ownership and value capture, and the discount bleeds across the category.

The Framework: Ownership vectors that drive token value

Ownership matters because it creates a credible claim on assets and cashflows. For tokens to be investable, tokenholder rights must connect to the system’s underlying economics. In practice, this means enforceable rights to control, constrain, or direct capital allocation, revenue routing, and key protocol decisions.

Tokens have a largely untapped opportunity to differentiate from traditional equity: ownership rights can be implemented and enforced directly onchain. When applied, those rights are programmatic, predictable, and transparently verifiable, and they can execute without relying on management discretion or intermediaries. Many tokens have not applied this capability to the surfaces that matter most for economic ownership, which is a core reason markets discount them.

The Ownership Token Framework focuses on programmatic economic rights, the rights that directly impact tokenholder economic exposure. Rather than treating “governance” as a proxy for ownership, we isolate the surfaces where enforceable control determines whether value can accrue to tokenholders or be bypassed. Each vector represents a category of rights over assets, permissions, or value routing that, when enforceable, materially affects token value.

Our methodology is rooted in mapping smart contracts:

- Identify the relevant onchain contracts

- Map permissions and control (owners, admins, roles, and who can execute)

- Assess mutability vs immutability (upgrade and parameter change authority)

- Inspect value flow and routing logic (how value is directed, where it can be diverted, and what controls prevent capture or redirection outside tokenholder mechanisms)

- Distinguish “exists in contracts” from “active in practice” using execution history and traces where relevant

Some economically material dimensions inevitably live offchain: IP, trademarks, domains, interfaces, commercial contracts, and bank accounts. The legal structure governing these surfaces can either reinforce or undermine tokenholder ownership, and it should be evaluated alongside onchain rights. Where offchain assets exist, a community-accountable entity can hold them subject to trust-reducing constraints that prevent, mitigate, and/or provide the community with legal remedies against potential abuses that could undermine token value (such as licensing IP to a competing project without sufficient benefit back to the community).

The Dashboard: An interactive database for investors and founders

The dashboard will be a visual, interactive database that applies the framework consistently and makes tokenholder rights and value accrual explicit, comparable, and verifiable.

It’s designed to do two things:

- Make diligence faster and more objective for investors. Tokens have too often been underwritten on narrative because ownership rights and value accrual weren’t legible. The dashboard standardizes how these claims are evaluated—and points to concrete onchain and (where relevant) offchain evidence behind them.

- Give serious projects a way to demonstrate investability. If your token has real ownership rights and credible value capture, you should be able to show it clearly. The projects that win won’t be the ones with the cleverest narratives—they’ll be the ones with verifiable ownership and durable value accrual mechanisms.

Leading protocols take ownership seriously and continue to adopt onchain primitives and legal structures that support enforceable tokenholder rights and value routing. We’ll roll this out in phases, starting with case studies that apply the framework to a set of leading protocols to validate the vectors and evidence standards, then expanding coverage over time. The initial set include examples illustrating different approaches to enforceable rights and value routing:

- Aave: Onchain governance over key protocol parameters and upgrades.

- Aerodrome: Anti-dilution rebasing mechanics and gauge system used to allocate emissions and incentives.

- Curve: veCRV and gauge voting used to allocate emissions and influence long-term incentive allocation across Curve’s pool ecosystem.

- Lido: Onchain governance over core protocol contracts, complemented by DAO-adjacent BORG structures for certain ecosystem activities.

- Uniswap: Fee switch and routing mechanisms, alongside the adoption of a Wyoming DUNA structure (“DUNI”) to engage with offchain requirements while anchoring to the onchain process.

The industry is ready for standards and tools that make ownership easier to evaluate. The Ownership Token Framework is expected to go live early next year, providing a structured, evidence-linked view across projects.

Apply to be featured

If your project is building real tokenholder ownership, we want you in the first cohort.

Being featured gives you a standardized, evidence-linked profile investors can use for diligence: what tokenholders control or own, how value accrues, where that’s verifiable onchain, and what’s supported offchain by tokenholder-aligned legal rights.

Help set a higher baseline for token investability by making token rights and value accrual explicit, verifiable, and comparable—so serious projects can differentiate on fundamentals.

Disclaimer: The dashboard is informational and designed to support diligence and design. It is not legal, financial, or investment advice.

Subscribe to The Eagle for weekly news on the Aragon Network